What I Read This Week...

Issue # 17 - Quick-commerce turbocharging the stationery category, India's pet-care market, building brands in the beauty space, new generation-old technology, benefits of dynamic discounting.

A shorter issue this time round, with some interesting stories that caught my attention -

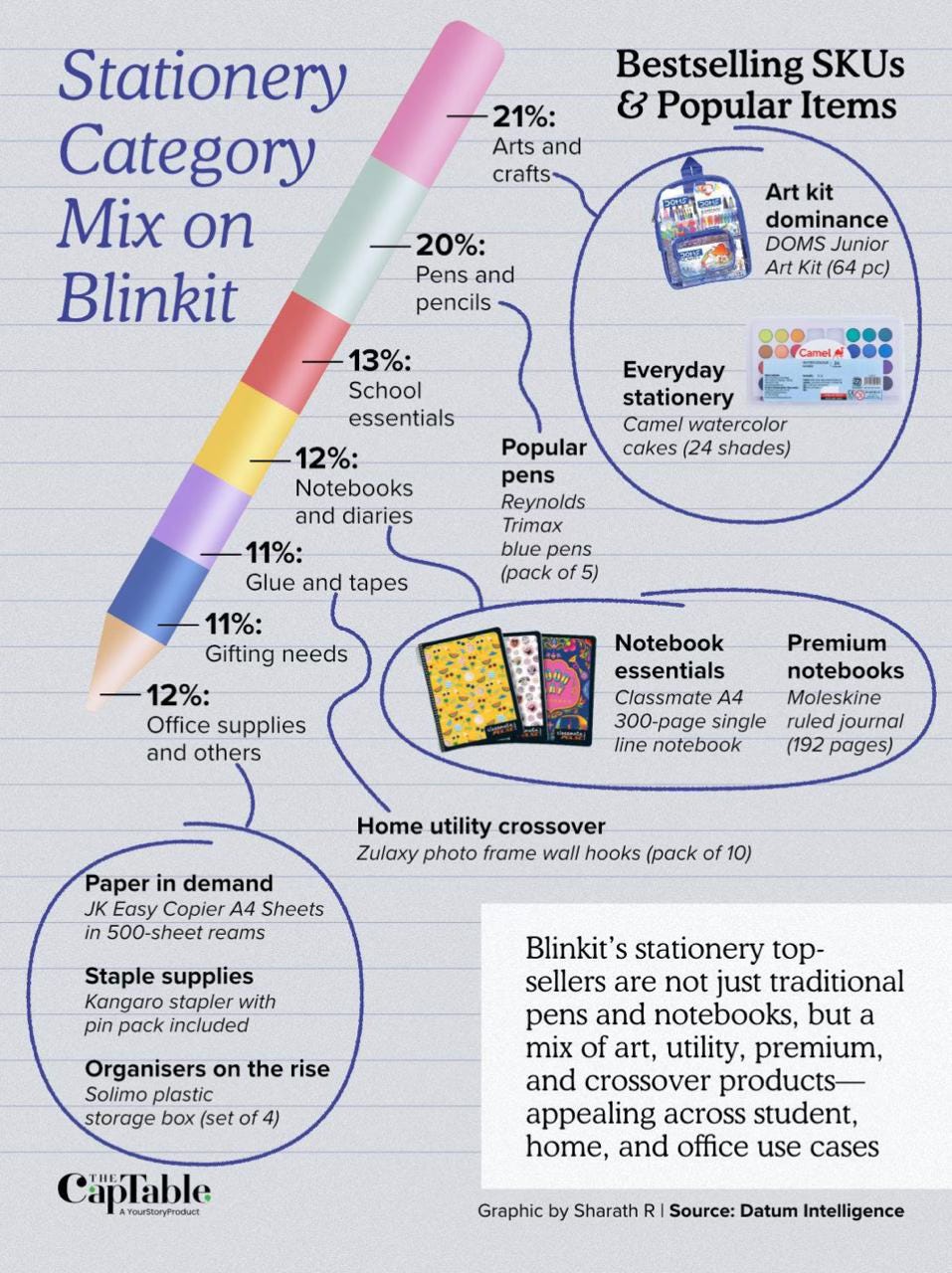

“How Blinkit turned stationery from fringe to a fast-moving INR 500 Cr+ category” - Stationery, once regarded as a planned purchase category bought at local shops or through Amazon, has become a fast-moving category on Blinkit’s quick commerce platform.

Thanks to Blinkit’s dominance, stationery items no longer rank in the top 200 SKUs on Amazon India, as buyers prefer Blinkit for variety and quick delivery.

Stationery sales on the platform now exceed ₹40 crore per month, with an annual run rate over ₹500 crore, concentrated mostly (80%) in metro areas, while Tier 2 and 3 towns remain largely untapped for growth.

The rise of quick commerce platforms like Blinkit presents a major opportunity for the stationery category in India to expand rapidly, especially in metros, by leveraging demand for convenience, variety, and fast delivery. On the flip side, small stationery shops may get impacted considerably in key cities as a result of changing purchasing behaviors.

India’s pet care market is on a remarkable growth trajectory, poised to reach $25 billion by 2032 with a CAGR of 20%, as per a report released by Unleashed at Purina - “India’s Pet Care Market: Innovation, Growth, and the Long Road Ahead”

Key trends shaping this surge:

Pet parenthood is booming, with pet numbers rising from 26M in 2019 to 32M in 2024.

Digital commerce, especially quick commerce, is revolutionizing how pet products reach consumers, fueling a 95% YoY growth in online pet product sales.

Urbanization and generational shifts see millennials and Gen Z treating pets as family, driving premium product and service demand.

Regional diversity: Metro hubs lead growth, while rising nuclear families in West and South India herald expanding markets in pet food, grooming, and vet services.

The future is bright for pet care startups and innovators, but closing the education gap and leveraging tech-enabled vet and pet services will be critical to unlocking India’s full potential.

Nestlé Purina views India as a future top-three global petcare market, driven by rising disposable incomes and the growing trend of pet humanization among younger generations. The company aims to shift cultural preferences from homemade to packaged pet foods to capture market share in this rapidly expanding sector.

With smaller packs and wider reach, Estée Lauder eyeing middle class in India, its key emerging market. Key points from an interview with the global president and CEO of The Estée Lauder Companies -

The group recently announced an overhaul of its global strategy that involves reaching more shoppers, accelerating innovation, and expanding its presence in high growth channels, markets and price tiers.

It operates in India in the premium beauty segment that accounts for about 10% of the country’s beauty and personal care market.

The CEO shared that the they will target the upper middle class in India, with plans to use small packs as a hook to draw more shoppers.

Around the world , between now and 2030, the number of consumers entering the middle class is projected to be around 500Mn, with over 30% expected to come in from India, making it the biggest contributor of consumers going into the emerging middle class.

India is the fastest expanding markets globally, having grown over 10% in 2024, driven by a 16% rise in prestige beauty. Only around 10% of the beauty market in India is in the premium beauty compared to 40-50% in more developed markets.

How India buys, builds, and believes in beauty today - Some key points from the notes by Radhika Agarwal from the podcast - WTF is Skincare - by Nikhil Kamath -

Gen Z embraces brands that proudly reflect Indian identity—“Made in India” is becoming cool, especially among affluent urban consumers.

Celebrity backing alone won’t cut it anymore; authentic storytelling and product excellence drive loyalty.

The fragrance category is breaking out, offering fresh opportunities in the INR 1-10k segment.

The minis economy is booming—smaller, beautifully packaged products are helping brands reach price-sensitive consumers and convert first-timers.

Clean beauty and ingredient transparency are no longer optional—they’re expected, especially by younger consumers.

What’s remarkable is how brands are evolving into content creators and community builders, making emotional connection as important as product performance. For anyone in the beauty business, this blend of heritage and modernity is a powerful call to innovate with empathy and authenticity.

“Young people are falling in love with old technology” - Driven by a feeling they’ve lost control to screens, teens and twenty-somethings are resurrecting CDs, flip phones and digital cameras

Many teens and young adults are increasingly opting for old-school devices like flip phones, point-and-shoot cameras, and CDs, seeking less screen time and more control over their lives.

Groups like the Luddite Club, with 26 chapters in high schools and colleges, promote digital breaks and analog lifestyles among youth.

Artists targeting young audiences are releasing music on nostalgic physical formats such as CDs, vinyl, and cassettes, reviving trends from the early 2000s.

The resurgence of old technology among young people signals a potential shift toward more intentional, less screen-centric lifestyles and growing demand for analog experiences. Brands and content creators may increasingly explore retro product lines and physical media, while digital detox movements could gain further traction. This trend suggests the future may blend digital convenience with periodic retreats into nostalgic, tangible experiences, shaping new hybrid consumer preferences.

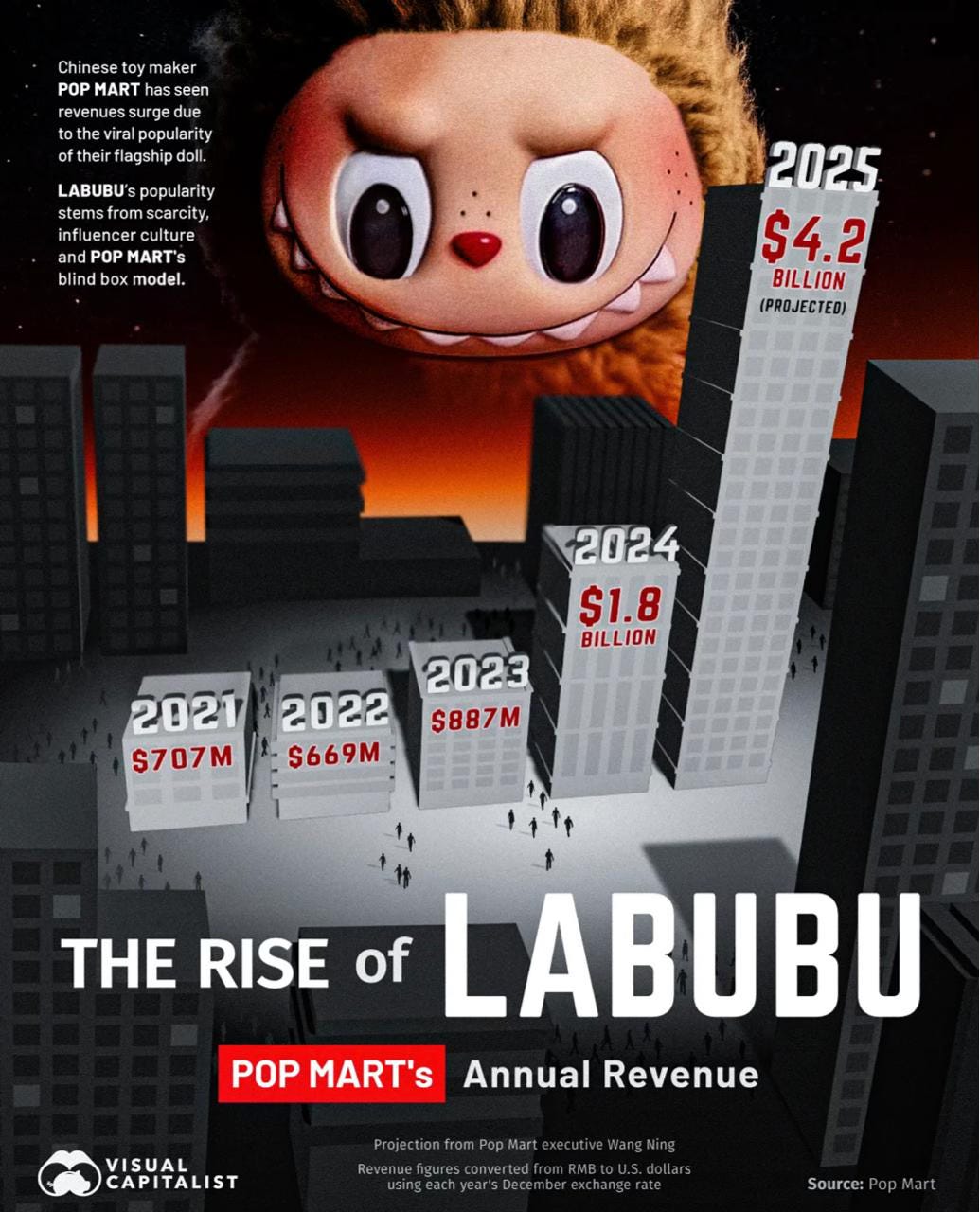

The rise of Labubu - Chinese toy maker Pop Mart saw its revenue double in 2024 to reach $1.8 billion as the excitement around the character Labubu began to grow.

Labubu’s popularity is boosted by Pop Mart’s blind box model, where the specific figure inside remains a mystery until unboxing. This drives fans to buy multiple boxes, fueling excitement and viral reaction videos. The surprise and anticipation create a strong social media buzz, deepening fan engagement and demand.

Pop Mart CEO Wang Ning said that it should be quite easy for the company to reach $4.2 billion in revenue in 2025, which would more than double 2024’s revenue.

“When Omnichannel Retailers Don’t Deliver What Customers Ordered” - As more retailers fulfill online orders from local stores, customers are increasingly receiving orders with missing or substituted items. These fulfillment failures may seem small, but they have lasting consequences.

Omnichannel fulfillment (ship-from-store) is growing but risky due to inventory inaccuracies and stockouts, with online grocery stockouts averaging 15%, higher than in-store.

Missing items cause direct revenue loss and reduce future customer spending, with reimbursements leading to a 7% revenue loss annually, which grows beyond 12% when factoring in reduced future spending.

Customers often respond negatively to substitutions, particularly when mismatches feel arbitrary or promoted items are missing, leading to mistrust and decreased loyalty.

Different products and customer segments react differently; perishable goods see quicker reorder, while promoted and non-perishables suffer more from fulfillment failures.

Retailers now allow customers to opt out of substitutions or provide real-time communication to improve experience, but prevention through better inventory management and tailored policies is critical.

Overall, managing fulfillment failures thoughtfully is crucial to maintaining customer trust and long-term revenue in the omnichannel era.

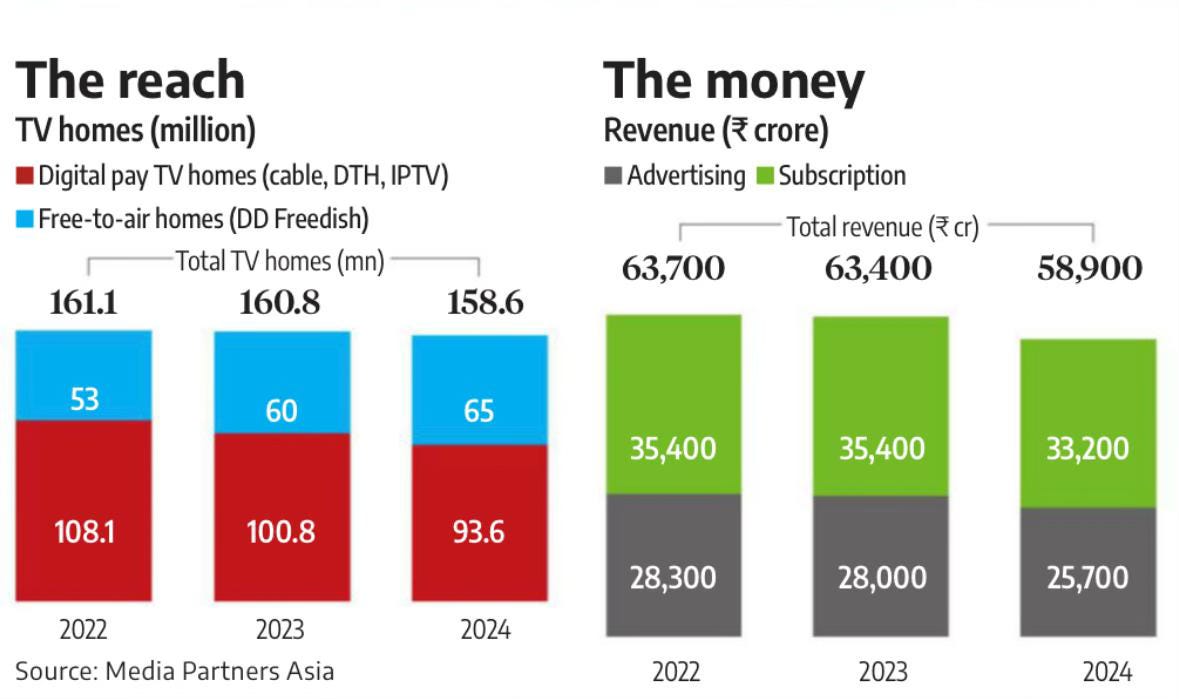

“Cracks on the screen-Can TV fix its slide with ads and smarter metrics?” examines the current challenges facing India’s television advertising market and how changing advertiser priorities, declining ad revenues, and evolving consumer media habits are impacting TV’s future.

Godrej Consumer Products stands out as one of the largest advertisers on television, spending ₹1,020 crore on advertising in FY25, with over 95% of this dedicated to large-screen TV (both linear and connected).

Overall, advertisers are leaving TV rapidly. A 20% drop in TV ad revenues in the first half of 2025 happened, marking a continued slide after three years of consecutive declines in both advertising and pay revenues.

Industry executives attribute this to structural changes in TV viewing habits, with digital and small screens capturing attention at the expense of traditional television. Only IPL (Indian Premier League) broadcasts showed ad revenue growth - other TV genres declined.

TV advertising is at a crossroads, needing major shifts both in measurement and content strategy to arrest the continuing decline and re-engage both advertisers and viewers.

A report on the future of taste by Oatly Intelligence WorldWide- predicting what’s next in beverage culture, flavors, numbers and trend. Key points -

The future of beverage culture is here, and it’s bursting with vibrant flavors, conscious choices, and global influences that are reshaping what we sip and savor. From East and Southeast Asian ingredients like ube, pandan, and yuzu making waves globally, to the remarkable 98.9% surge in US pageviews for hojicha in 2025 — the flavor landscape is evolving fast.

Health-conscious consumers are driving the rise of decaf and natural sweeteners, with daily impressions for decaf soaring 90x this year. Fibremaxxing (up 9500% in media mentions!) is transforming gut health into the next wellness obsession, backed by a booming $13.26 billion global prebiotics market forecast by 2029.

Locality matters more than ever too — signature drinks crafted with native ingredients like Finnish forest berries or Australian lemon myrtle are becoming cultural currency, fueling adventurous palates with 85% of baristas noting bolder Customer tastes.

And let’s not forget matcha’s spectacular global rise, fueled by wellness trends and social media, despite a slight dip after peaking in August 2025. Its versatility and health appeal keep it a staple across continents, with emerging contenders like hojicha and ube ready to share the stage.

The takeaway? Consumers crave authenticity, health, and novelty in every sip — making the world of beverages as dynamic and diverse as the cultures we find them in.

Dynamic Discounting: How to Do Dynamic Pricing Right -Dynamic pricing doesn’t have to turn off customers. Wharton’s John Zhang says companies can correct perceptions of unfairness by clearly communicating the value.

Dynamic discounting allows suppliers to offer variable discounts to buyers for early invoice payments, with bigger discounts for quicker payments, optimizing cash flow for both parties. Alphabet/Google uses SAP Ariba’s dynamic discounting platform, enabling them to pay invoices early and receive prorated discounts like 2%/15 net 45 or 1%/30 net 45, boosting savings while suppliers improve working capital.

Buyers benefit by reducing costs through early payment discounts, while suppliers receive faster payments, enhancing liquidity and strengthening supplier relationships.

Unlike static discounting, dynamic discounting offers flexibility and control to both buyers and suppliers, making it a win-win approach in modern supply chains. Leading companies like Coca-Cola use dynamic discounting to decrease days sales outstanding (DSO) and improve financial health across their supply chains.

Mastering dynamic discounting is key for businesses looking to optimize working capital, foster strong partnerships, and gain competitive advantage in today’s market.

That’s a wrap of this issue !

Great to see your post here after a long time! Enjoyed the insightful compilation.