What I Read This Week...

Edition # 16 - The Kodak dilemma, the great Indian snack slowdown, foodluxxing, Luckin coffee's playbook, the fifth wave of India's coffee journey and other stories.

The following pieces caught my attention during the past few days - sincerely hope that it helps, and you find the same interesting too.

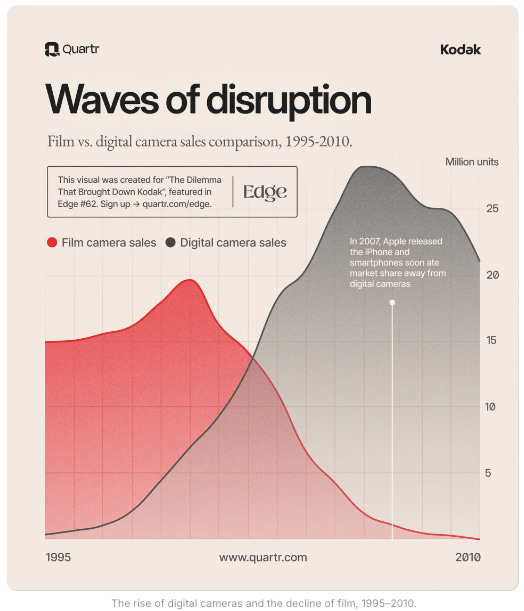

The rise and fall of Kodak is well documented. A few know about the dilemma that brought down Kodak. From the first camera for the masses to the invention of the digital camera itself, Kodak helped shape the very future it would later fail to claim. Some key insights from the post in Quartr -

The genius of the Kodak camera lay in its simplicity. Their campaign in 1888, wherein ‘you press the button, we do the rest’ epitomised all that Kodak stood for then.

Kodak created an entire ecosystem around the cameras - cameras, films, development and printing - not only for the consumer industry but for institutions also, like hospitals.

The interesting bit about Kodak, was that it was an early innovator. Sadly, they become too big, and failed to recognise that their very own invention had the potential to disrupt their industry. A young electrical engineer named Steve Sasson built a working prototype of the world's first digital camera, that captured black-and-white images at 0.01 megapixels and stored them on a cassette tape.

Kodak's leaders didn't dispute the innovation, they just didn't want it. Why promote a technology that would cannibalize their billion-dollar film business?

Where Kodak hesitated, Sony,Canon, Fujifilm, Nikon and others leaned in. And as they say the rest was history!

An important piece of advice from George Eastman, the founder of Kodak, decades earlier was - “The world is moving, and a company that contents itself with present accomplishments soon falls behind.”

If you are someone facing a similar dilemma like Kodak faced, it will be worthwhile to read the 1995 HBR article - Disruptive Technologies: Catching the Wave by Joseph L. Bower and Clayton M. Christensen, which postulates that the fundamental reason companies succumb is because they stay close to their customers. They do this by remaining focused on the demands of the mainstream customers, rather than considering the emerging needs of customers, who may seem niche in the beginning.

Is it time to get plastic out of chewing gum ? Did you know that the chewing gum is a ‘significant but overlooked’ source of microplastic ingestion and environmental pollution, with research showing that a single piece of plastic gum can release in excess of 250,000 microplastic particles into the human body, as presented in the article from Food Navigator Europe. Plastic free chewing gums are a way forward, and the global market for the same, which is currently valued at $132Mn (a tiny drop in the overall chewing gum global market valued at $18.49Bn) is expected to grow at a CAGR of 9% to $242Mn by 2031.

The Great Indian Snack Slowdown: Key Trends, Challenges, and Strategic Opportunities for 2025. The Knowledge Company presents an in-depth analysis of certain critical data behind the packaged snack food consumption slowdown. Some key insights -

Kantar states that that overall packaged snack consumption per household in India has held steady at ~12.8 kg in FY25. The volume growth rate has declined from a robust 9% in FY24 to 4% in FY25. Reaching more consumers cannot be the only mantra for growth. Rather winning a larger share of wallet will be critical.

Biscuits account for 56% of the total volume of the snacking industry in India. Growth rate has dropped from 10% in FY24 to just 1% in FY25.

Savoury snacks, which includes everything from western-style potato chips to traditional namkeens, has seen its growth moderating from 11% in FY24 to 7% in FY25.

Some key factors impacting the growth across, have been - food inflation (which has led to ‘shrinkflation’), post pandemic normalization, consumer fatigue (monotony due to a paradox of choice, thanks to the multiple ‘me-too’ products in the market), coupled with innovation deficit.

Consumers are becoming conscious of what they eat, leading to the development of a new mindset wherein they are looking for guilt-free indulgence, clean labels and lesser calories.

Will the movement become mainstream ? Challenges exist - topmost being cost and the perennial question of ‘if it is healthy, will it be tasty’?

FoodBev’s opinion on ‘Foodluxxing - The lipstick effect’s culinary cousin’ states that when budgets tighten, consumers don’t always cut out indulgence – they scale it down.

Rather than cutting out indulgence altogether during economic stress, consumers are reframing luxury in smaller, more accessible formats, trading big-ticket items for elevated everyday treats.

Small luxuries provide emotional comfort, status signalling and a sense of perceived value.

Foodluxxing highlights how consumer behaviour is evolving beyond simple price sensitivity. It reflects a broader cultural shift toward mindful, intentional indulgence, where emotional satisfaction, social connection, and sensory experience are as important as cost.

As a CPG professional, my most interesting journeys have been across the North Eastern markets of India. Interesting, because you go in for the first time with a certain mindset, and you come out with a completely different experience. Hence, reading the the article ‘Why online brands need to take the NorthEast shopper more seriously’ in TheCapTable, comes as no surprise. Key points -

Internet and cultural influences are fueling faster adoption.

The North East is punching above its weight in India’s online shopping scene. Online spends in North East households are the highest at 9.3% across India, much above the national average of 7.8%.

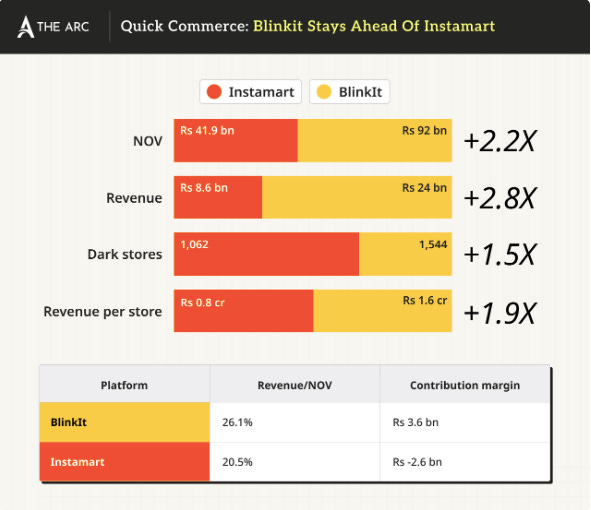

Food-delivery major Swiggy saw a growth of 12% from previous quarter, posting revenues of Rs.4961Cr in Q1FY26. However, Swiggy’s net loss went up 96% YoY, to Rs.1197Cr as per the article in TheArc, impacted gains at Instamart.

Swiggy’s quick commerce arm, Instamart, saw its adjusted revenue increase by 17.2% QoQ to Rs.859Cr, while the adjusted EBITDA loss stood at Rs.896Cr.

Instamart’s net AOV of Rs.453 was higher than the previous quarter.

However, the challenge seems to be clear and present with respect to its cash reserve, which was at Rs.5354Cr as of Jun’25. At the current cash burn-rate, this implies a runway of around 5 quarters. To grow it will need a lot of money! And given the intensity of the competition, expect the cash burn to continue with the path to profitability still seemingly way in the future.

The overlooked barriers to India’s next ecommerce boom cycle (TheCapTable). Bain identified 3 global trends reshaping ecommerce. While India dominates in one - quick commerce, it lags in the other two - hyper-value commerce (a model focused on offering ultra-low-priced assortments to attract price-sensitive consumers, particularly those in lower-middle-income brackets in smaller cities) and trend-first ecommerce (a model that prioritizes launching new products rapidly in response to current trends, influencer content, and viral social media moments, rather than relying on traditional product development cycles).

Amazon’s big play is ads and Q-comm’s the new billboard (Mint Mumbai). Amazon Now, the new quick-commerce venture of Amazon, is expected to open up more advertising space. In fact. Amazon India’s advertising and allied services revenues grew 25% in FY25, against a 21% growth in its mainstay marketplace business. Digital media makes for over half of all advertising spending in India, and ecommerce firms together generated $3Bn worth of advertising revenue last year. Amazon already accounts for a third of this. With a total ad revenue of $600Mn last year quick commerce is now adding up to be a valuable lever for platforms.

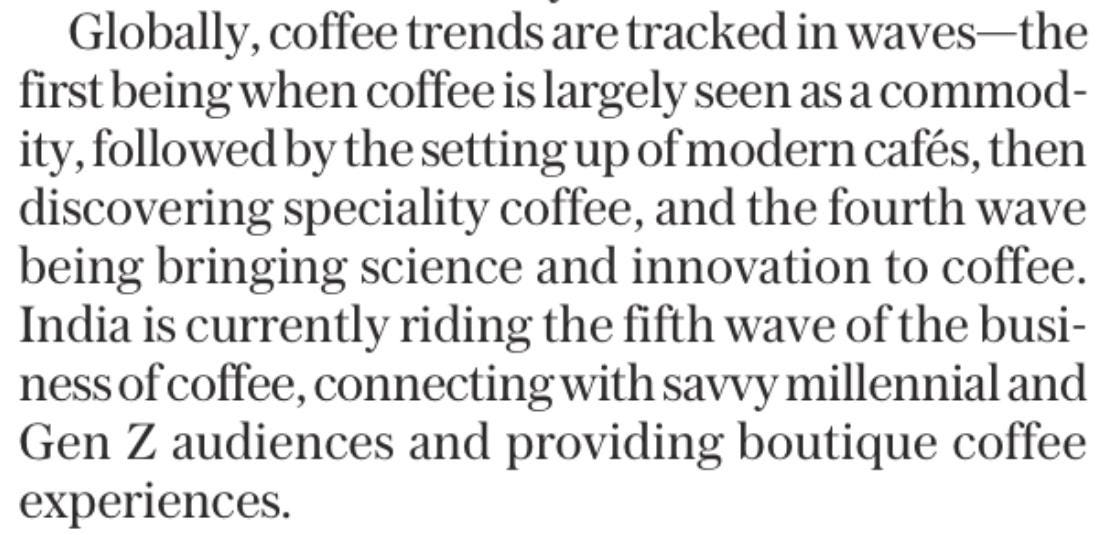

India is in the fifth wave of its coffee journey with coffee lovers, planters and entrepreneurs promoting homegrown varieties in boutique settings, as per the cover story in Mint Lounge.

Despite a 40% increase in the per capita consumption of coffee in 2024, as per the Coffee Board in India, to about 100g, it’s still very low compared to Europe, where it is about 6kgs.

In another tea drinking market - China, Luckin Coffee has scripted the turnaround of the century as explained brilliantly by Michelle Wiles, in her post (Diary of a Brand : Luckin Coffee) on Medium.

In 2021, the year of Luckin’s bankruptcy, per capita coffee consumption in China was only 9 cups per year, or 2.74% of the United States’ 329 cups per year.

Instead of a low cost chain that pushed discounts to acquire customers, Luckin would transition to an elevated model that pulled in full-priced audiences with hit products and an elevated brand.

Luckin took three steps that any brand can emulate to make their own transition: They launched in-demand products. They layered them with aspirational associations. And they got these products directly in front of the right consumers.

The puzzle of why rural India is consuming more in The Daily Brief by Zerodha, goes deeper into the reason behind why products are moving out of rural shelves for the past six quarters, pointing that the recovery has some very shaky foundations.

An above average monsoon, coupled with lower inflation has definitely helped rural households, given that they spend a larger share of their budgets on food.

Research by Systematix, in its Household Situation Tracker points in a different direction. Demand looks better because prices cooled, but not because wages grew.

Savings have dropped to 13.2% of income, while the consumption-to-income ratio has climbed to 65.6%. Food now takes up 53.8% of the monthly budget, the highest in the series. In effect, that high share squeezes what can be spent on education and health spending. One in five rural homes is back to borrowing from informal sources.

Among the other articles that I read during the past week were -

Top confectionery trends driving sales in 2025 (foodnavigator.com).

The Capital Markets Day presentation made by The Magnum Ice Cream Company (Quartr). Check out a few slides which have interesting insights on the overall ice cream market globally.

The snackdown - How a pack of chips became a scandal (Bakery & Snacks).

Coca-Cola’s Playbook : Brand power, local strategy & global impact (FoodNavigatorEurope).

Fashion apps push for 60 min deliveries in quick commerce’s new era (The Arc)

This time it’s serious : How Kiranas are fighting back (TheCapTable).

An update on US consumer sentiment : Settling in for a tepid holiday season (McKinsey & Company).

At the airport, there’s a fanch new lounge everywhere you look - airlines and credit card companies are taking over terminals with ever swankier amenities, and loyal customers can’t get enough. (The Wall Street Journal).

Amul’s protein push, and Nestle in Crisis | Who said What ? (The Daily Brief by Zerodha).

How Zepto’s Brand Engine Keeps Its 10-Minute Promise Alive (Inc42).