What I Read This Week...

Digital advertising, fast fashion, quick-commerce reports and the state of the Indian FMCG industry among others.

Over the decades, the way consumer facing organisations have disseminated information to their potential consumers, and how the same has been consumed and acted upon by such potential consumers has changed considerably.

Consumer goods companies would in the past rely on the traditional route to market, wherein they would have large sales teams or channel partners to reach out to the millions of stores dotting the country. Once such goods would have been placed at a certain percentage of the their covered stores, they would begin the process of informing their potential consumers about the product - either through print or television ads, and try to influence such consumers to go to the stores and buy their offering.

What’s changed now is the way consumer facing companies reach out to their end consumers - current and potential, as well as how they make their products available to such buyers.

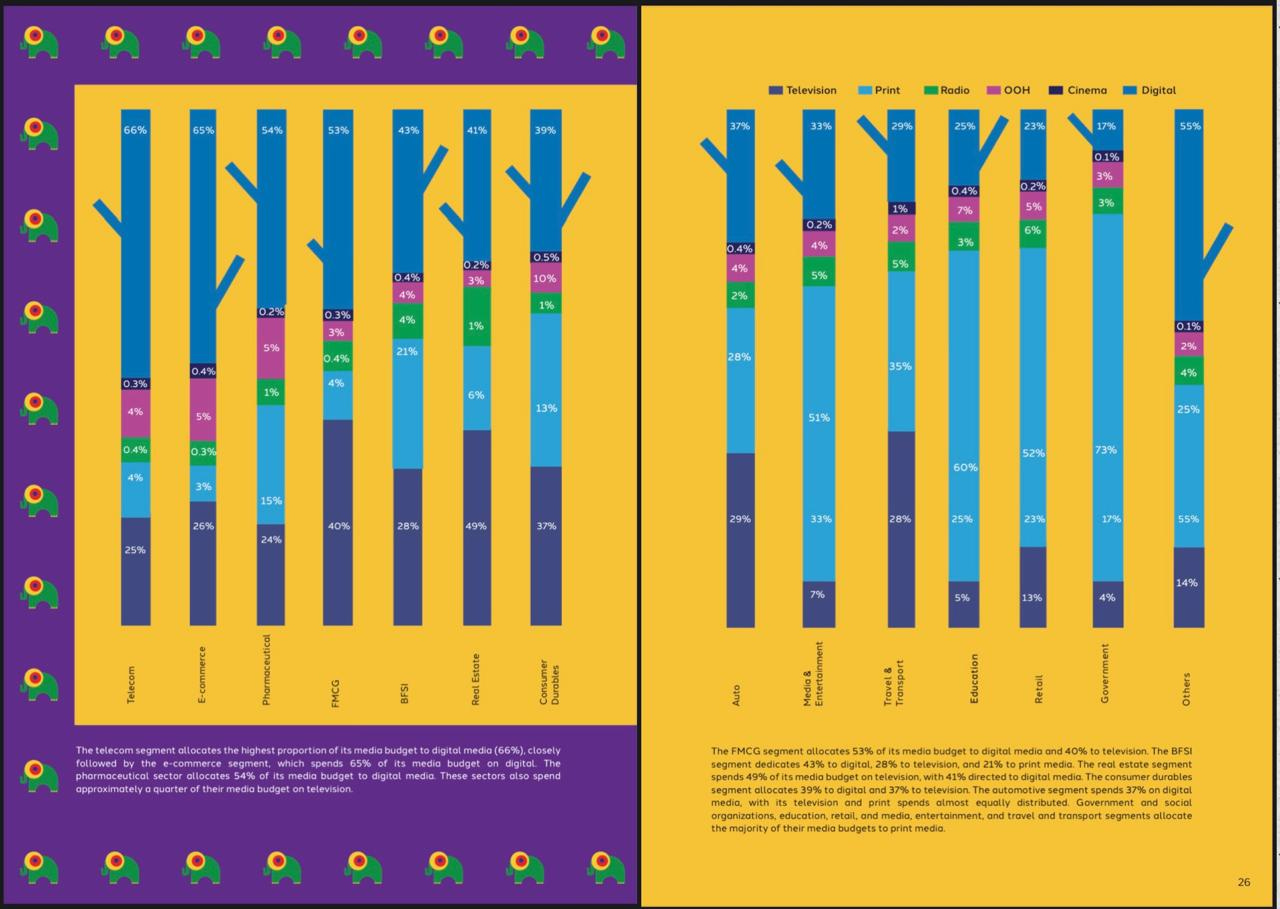

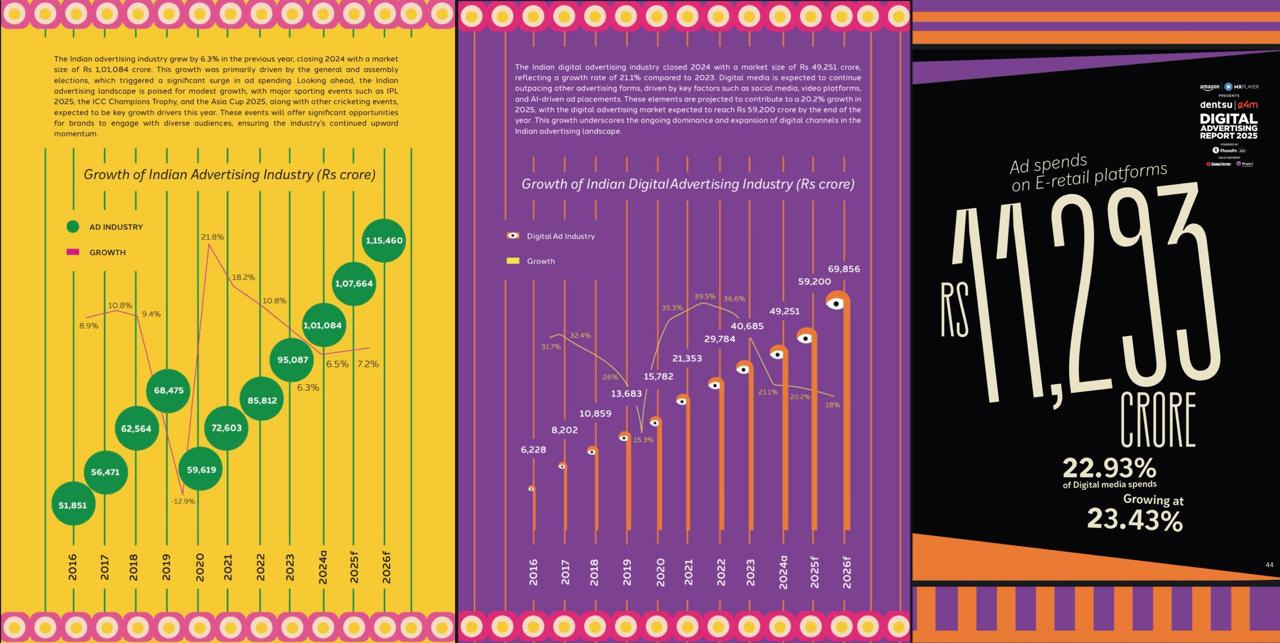

Denstu India recently launched the 9th edition of its flagship annual report, the ‘dentsu Digital Advertising Report 2025’ – a deep dive into India’s evolving advertising ecosystem. Some key highlights from this report were that -

Digital advertising today claims the largest share of advertising spend. While the overall advertising industry is expected to grow at a CAGR of 6.87% between 2024-26 to $13.91Bn from $12.81Bn, the digital advertising space is expected to grow almost 2.8 times faster to $8.41Bn, to command a share of 61% by ‘26, from the current level of ~49%.

Television and print have a share of 28% & 17% respectively.

OOH continues to show consistent growth, although the pace has slightly slowed from 12% last year to 10% now.

Cinema's performance remains highly variable, with a modest growth coming through in 2024, likely driven by blockbuster releases and a post-pandemic resurgence in theatre attendance.

The FMCG segment continues to dominate the Indian advertising space, contributing 31%, followed by e-commerce and quick commerce brands that capitalize on impulse

buying. It allocates 53% of its media budget to digital media and 40% to television.The telecom segment allocates the highest proportion of its media budget to digital media (66%), closely followed by the e-commerce segment, which spends 65% of its media budget on digital.

Within digital media, FMCG directs 44% of its budget to online video, while e-commerce prioritises paid search (39%) and social media (31%).

Social media and online video lead digital media spending, with social media contributing 29% & online video close behind at 28%. Online video is expected to grow at a rate of 27.60%, reaching a 30% share of advertising spend by the end of 2025, on par with social media.

Advertising spends on e-retail platforms contribute to 22.93% of all digital media spends.

Retail media has become a major disruptor in the digital advertising landscape in recent years and is expected to account for 22.93% of total digital media spends, exhibiting a a growth rate of 23.43% over 2023.

As consumer attention spans keep shrinking and brands try to figure out new ways to hold the same, what’s seeming clear from this report is that the face of engagement will keep evolving.

On the other hand, how consumers look to get their brands is also changing fast.

What was earlier got through offline stores - and that too, the friendly neighbourhood Kirana store - has shifted (atleast in part) to self-service stores as well as online platforms and sites. For FMCG companies. online channels are now contributing 10-12% of their overall sales, and quick commerce platforms account for a third of that.

In fact, companies have clearly started to focus on each channel separately by having dedicated teams to provide different sets of SKUs (stock keeping units) to each channel, and maybe even their key accounts.

Access to information and the ability of brands to reach out directly to end consumers, has enabled a growth in the addressable market for almost all brands, particularly luxury brands. The growth of e-commerce has democratised access to luxury. Alongside the affluent who have been exposed to luxury, the Henry cohort (high earners, not rich yet) is driving the demand for luxury goods. This cohort includes consumers who are high earners but whose income is largely dedicated to covering a high cost of living. The term HENRY was originally coined to describe a segment of millennials who are just now hitting their peak income years and may be likely to attain higher assets and affluence over time. Interestingly, HENRYs are driven by aspirational spending behaviours. This, in a way, will also contribute to the growing demand for premium products and experiences. Tata Cliq Luxury, it is reported, gets 55% of its sales from non-metros like Panchkula and Mysore.

Another segment within the larger consumer space which is seeing a lot of interest is the fashion industry. The global industry was estimated to be worth $1.7 trillion in 2023, and is expected to touch $3 trillion by 2030. The purchase of garments on a per capita basis has been increasing, in part due to the rise of fast fashion.

Fast fashion retailers move faster than their traditional counterparts do. This means that they compress production cycles and turn out up-to-the-minute designs, enabling shoppers to not only expand their wardrobes but also refresh them quickly, and cheaply.

Fast fashion retailers have consolidated their position in the American market: retailers such as Shein and Temu are now the primary online fashion marketplaces in the United States—fast or otherwise.

People are buying more clothes than ever: by 2030, global apparel consumption is projected to rise 63 percent, to 102 million tons. And fast fashion consumers are quick to throw clothes away, thus creating considerable waste.

For every five garments produced, the equivalent of three end up in a landfill or are incinerated each year. Total greenhouse gas emissions from the production of textiles clock in at 1.2 billion tons a year—that’s more emissions than all international flights and maritime ships combined.

While Gen Zers are becoming more mindful of sustainability, there is a gap between action and intention.

Beyond fast fashion, there is ultra-fast fashion, which moves even faster. Shein, Zara and H&M are some key players in this space, with Shein being the key player here. While Zara delivered 6850 new items in 2022 compared to 4400 new items for H&M, Shein launched 315,000 new items ! The brand launches in 2 days what H&M offers over several months.

The India Fast Fashion market size was valued at US$ 9.90 billion in 2023 and is expected to reach US$ 28.84 billion by 2030, grow at a compound annual growth rate (CAGR) of 16.5% from 2023 to 2030.

The key drivers for fast fashion in India have been -

Increasing disposable income and fashion consciousness.

Proliferation of e-commerce and m-commerce channels.

Organized retail penetration in Tier 2 & 3 towns.

Increasing participation of women in the workforce.

Basis their price points, fast fashion in India can be classified into 3 types - Ultra Value (with Zudio dominating in this segment), Premium (with Zara having the biggest moat, given their brand recall and loyalty) and the Mid-Value segment (with brands like H&M), where there will be the highest competition given the low entry barriers and also because customers in this segment are also fairly experimental.

Shein is re-entering India in a partnership with Reliance, after a gap of 4.5 years, posing a formidable challenge to established players in a rapidly expanding market.

And if we are talking about anything ‘fast’, there’s no escaping a look at the quick-commerce space in India, which has been growing and gaining attention globally for the seemingly successful model adopted here.

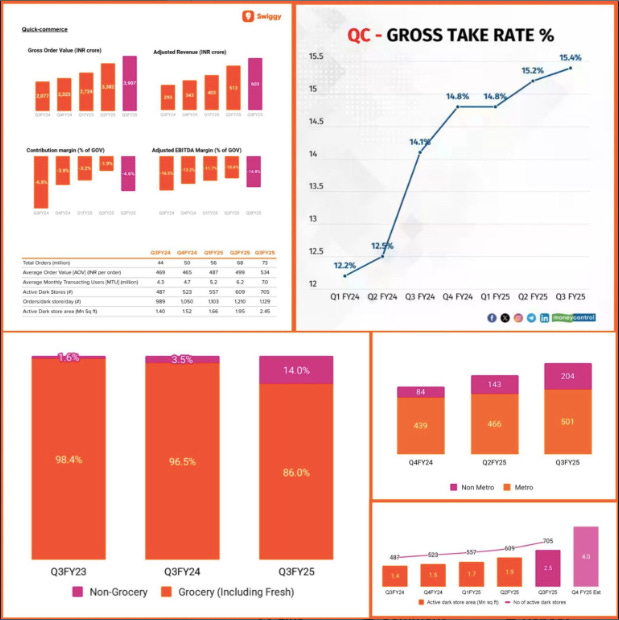

Over the last few weeks, both Zomato and Swiggy released their Q3’25 quarterly earnings report. These reports give a broad idea of how the quick commerce space is faring in India.

Blinkit & Swiggy Q3'25 Performance Some common themes, for their quick commerce verticals which both, Blinkit & Instamart, are looking to drive harder were that -

The growth pedal is being pushed at from two perspectives - (a) getting more potential users to experience the convenience and benefits of quick-commerce (or addressing the ‘latent demand’ as the shared by the Swiggy team), (b) setting up more dark stores and mega pods to cater to more cities, pin-codes, and more quickly.

The increase in the dark stores - be it megapods, bigger ones or simply more of them - will also help such players to increase their assortment, something which all players, including the likes of Zepto & BigBasket having been doing for the last few quarters. The attempt is an effort to drive up average order values (AOVs) and hopefully profitability, given that grocery items tend to have thinner margins comparatively.

Each of the above actions has led to an increase in spends. Customer acquisition costs have shot up, given the fact that there are multiple players trying to do the same thing. And one thing that attracts customers, is that of getting a ‘good deal’ on any platform. So, discounts have increased across platforms. You can expect brands (which at an overall level, consumers trust more) to be discounted more and unbranded items (say, fruits and veggies) to come at a relatively higher cost compared to the open market.

Given the growth that brands are seeing from this channel, and not as much from other channels, expect spends on retail media to increase on such platforms.

Overall profitability will continue to remain a concern for all players, impacting the valuations for the listed players, atleast for a few quarters.

You can check out the detailed metrics’ performance for Blinkit & Instamart.

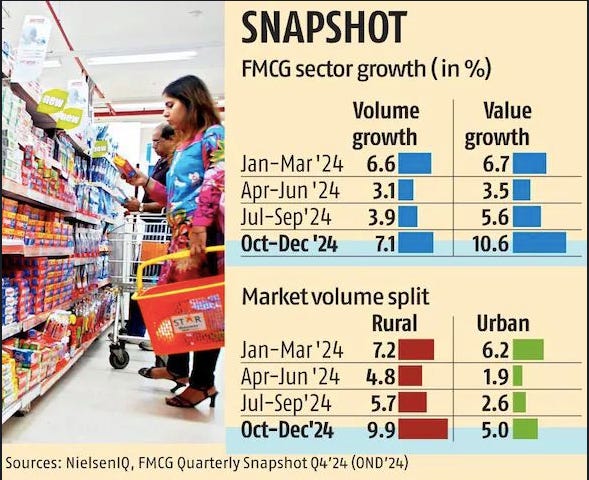

India’s FMCG sector reported a 7.1% YoY growth in volume terms for the quarter ending Dec’24, as per NielsenIQ against the year-ago quarter’s increase of 6.4% - the best quarter in the past year !

Sales volume jumped 9.9% in rural areas in Q4’24, up from 5.7% in Q3’24 and double the 5% increase in urban markets. Despite the relatively softer growth for urban markets, it was much better than the growth of 2.6% in Q3’24 and 1.9% in Q2’24 (that’s some cheer indeed).

In terms of value, the growth recorded was 10.6% for Q4’24, faster than the 6.5% in the same quarter a year ago. The growth of Q4’24 seems great when compared to the earlier quarters. In this quarter, there was a combination of consumption and pricing driving the overall growth, given the 3.3% increase in prices.

Apart from price increases, a preference for smaller packs - given that there was a higher unit growth compared to the volume growth - during the festive season, and lower grammage helped companies overcome the consumption slowdown that has weighed down the sector in the past quarters.

As consumers moved to smaller packs, the unit growth, or the number of individual units sold, stood at 8% during the quarter, higher than 3.6% in the preceding quarter.

Traditional trade volumes grew 8.1%, compared to 3.9% growth last year, while modern trade volumes fell 1.1% as compared to 20.2% growth in the same period last year.

Food consumption growth rose to 7% in Q4 ‘24, up from 3.4% in Q3’24, driven by increased volume in staple categories such as edible oils, palm oil, and packaged atta, despite price hikes.

Health and personal care categories consumption growth saw an uptick, reaching 7.3% in Q4 ‘24 compared to 5.4% in Q3’24, with higher consumer demand observed in both urban and rural areas.

Meanwhile, OTC categories like rubefacients and analgesics experienced a 13% growth in value sales in Q4, supported by a 10.6% increase in prices.

In Q4 2024, food contributed 61% of FMCG sales, followed by 32% from Home and Personal Care products, with the remaining 7% came from OTC products.

NIQ pointed out that smaller, affordable packs from small & medium manufacturers were boosting consumption. Small players achieved a growth of 14.2%, while medium-sized manufacturers grew 13.3%. The large consumer goods companies are seeing slower value growth, though they are still growing at twice the rate compared to Q3’24.

In terms of volumes, small players have seen a notable growth of 9.7% during the festive quarter driven by staples and laundry items. Medium players also reported a volume increase of 8.7%. However, the giants only saw a 4.4% rise in volume.

NIQ’s latest figures follow recent weak commentary from consumer goods companies, which cited moderating urban consumption in the Q4’24 due to high food inflation and tepid real wage growth.

Small format MT stores are seeing a contraction in demand, leading to the overall MT volume decline.

Some of my other reads included -

Luxury retailers continue to show keen interest in expanding their footprint in India, with 27 new foreign retail brands having entered the country in 2024, primarily in the fashion and apparel segment, and accounted for nearly half of the total luxury space leased during the year.

Digital transformation done wrong: Lessons from a customer's perspective.

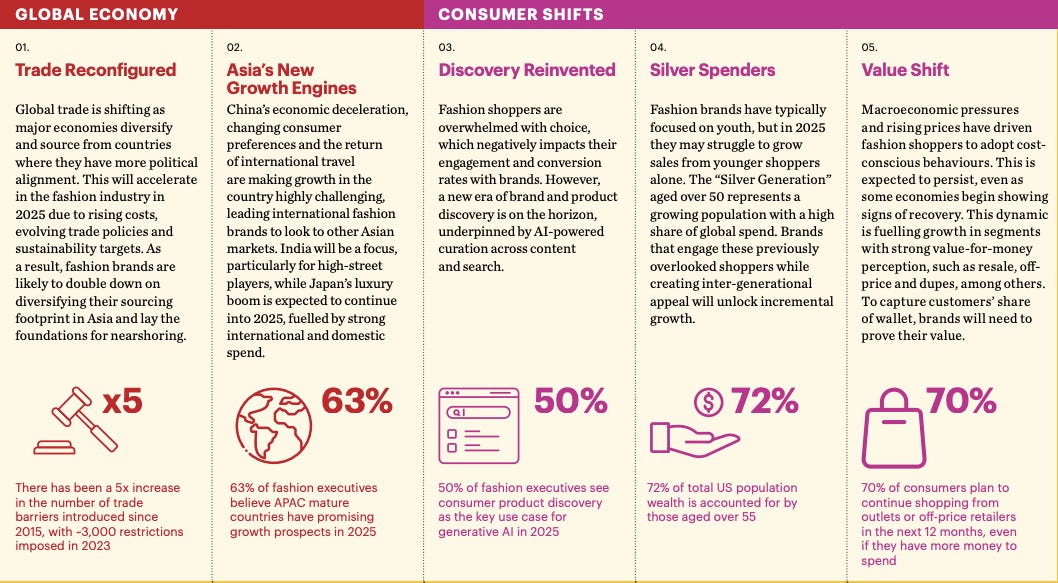

Fashion executives have a positive outlook for other Asian countries, particularly India and Japan as reported in ‘The State of Fashion 2025’ from McKinsey.

Will lack of internet skills prevent seniors from travelling ? While young faces take the spotlight in discussions about tourism, senior tourists with their discretionary savings and spare time, possess significant resources and chances to travel. Desirability, feasibility, internet self-efficacy and choice of a travel companion could be some aspects that can help marketers to influence such potential customers.

Dmart in the age of quick-commerce : a LinkedIn post by Arjun Krishan Puri.

Reliance Consumer Products Ltd (RCPL) magic potion for working towards pole position in the FMCG space seems to be to acquire small(er) brands which at one point of time had a good brand equity, or today operate in a region of the country and then using the classical pricing play to drive distribution and acceptance amongst Indian consumers. Their latest acquisition is the INR 240 Crore SIL brand. Interestingly RCPL touched a topline of INR 8000 Crores in the first nine months of 2025, growing their distribution network by a whopping 300% YoY. They have also entered the sports drink category with ‘Spinner’, a brand co-created by cricketer Muttiah Muralitharan, at a price point of INR 10, with the hopes of establishing a $1Bn sports beverage category in India in the next 3 years.

Why is the luggage sector struggling amid the boom in travel? A moneycontrol.com research report.

If Indian retail wants to win, it must shift from discounts to building long term loyalty. A LinkedIn post by Vineet Gautam.

Liquor sales in 2024 decelerated, mirroring similar slowdown in other consumer discretionary such as apparel and footwear after two years of runway growth. The country’s liquor makers sold 418Mn cases last calendar year, up from 408Mn cases in 2023.

Urban consumption slowdown in India continues, leading to consumers buying smaller packs of soaps, but are availing flexible payment schemes and EMI plans to buy premium durables and pocket heavy items like jewellery.

Why D2C brands are putting their money on small packs with big hopes - Slowing consumption in urban India, cautious consumer sentiments, and high inflation have prompted new-age personal care and FMCG brands to shift gears and focus on smaller stock-keeping units and compact versions of their products.

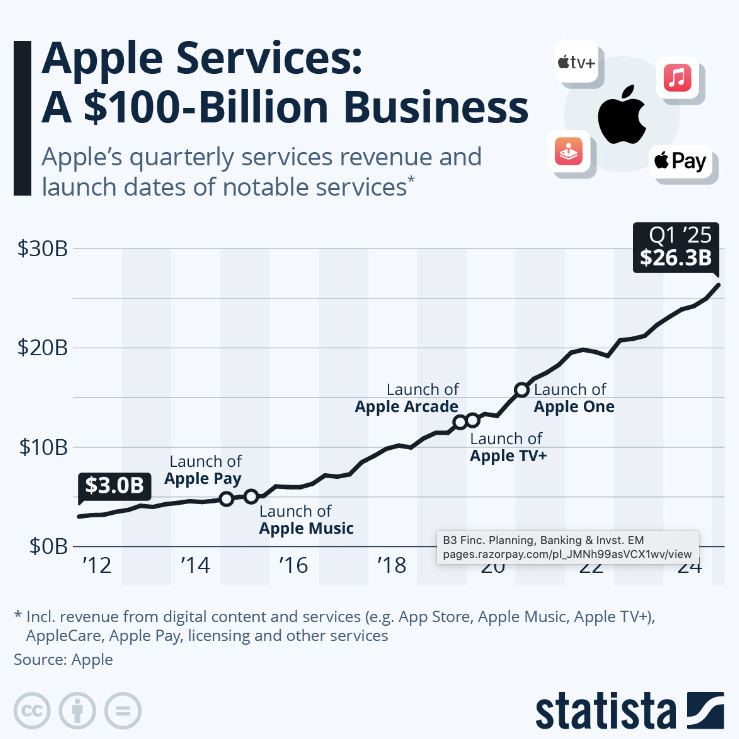

Apple's services division, which includes Apple Pay, Apple Music, Apple TV+ and the App Store - among others - reached an all-time revenue high in the first quarter of fiscal year 2025. Apple’s quarterly services revenue climbed to $26.3 billion in the three months ended December 28, up from $12.7 billion five years ago.

Some reads from the food & beverage space were as follows -

From ‘hyper-crunch’, to ‘air’ and ‘mouthfeel. mimicry’ - 9 mouthfeel trends to watch in 2025. You can also download the full report from Tate & Lyle here.

Linked to one of main articles in this post on fast-fashion, within the larger food space, do consumers still care about sustainability ? As per a recent consumer survey, just 9% of Europeans prioritise sustainablity in their lives, and the number of consumers who consider sustainability when making purchasing choices, has declined from 51% to 46% since 2020.

Dizzying prices of cocoa and tariff wars could turn out to be global food’s biggest anxieties.

Colours in food are not just for decoration. They play an important role and can even evoke particular tastes, moods and sometimes memories.

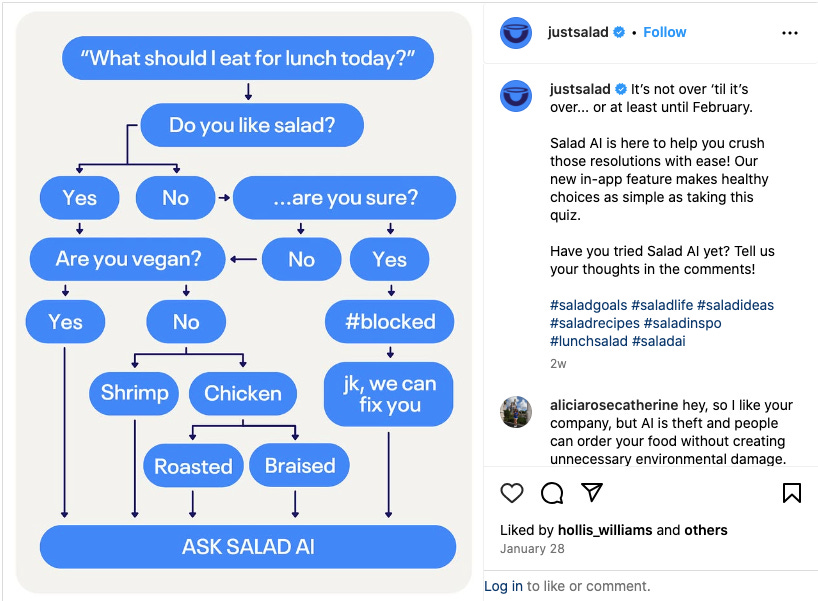

Just Salad is serving up a new recipe for customer satisfaction with Salad AI, a tool that takes the guesswork out of ordering a customized salad. Acting as a thoughtful personal chef, it inquires about the user's dietary preferences, nutritional goals and flavor cravings through a simple survey in the brand's mobile app.

That’s it for this edition of All Things Consumer !

Thanks for reading this edition - it will be great to hear your thoughts on the same and your views on any of the topics covered.

This is so well researched